Monthly Letters

-----------------------------------------------------------------------------------------------------------------------------------------January 2026

Dear Valued Client,

The past year has been eventful and quite positive as anticipated. The Federal Reserve began its reduction of key interest rates to their lowest in several years. As we write, the Fed has hinted at further rate drops in 2026. Consensus opinions of most large investment firms are calling for 10-15% profit

growth for the SP500 companies and therefore, a positive year is predicted. Obviously, time will tell. Artificial intelligence has dominated economic headlines and AI-driven companies have dominated stock performance and return. 50% of the broad stock market index returns have been driven by the

Magnificent Seven; mega-cap technology, and artificial intelligence-related companies. We are pleased with the performance of our clients’ accounts. The broad market index returns for 2025,as of market close 12/31/2025) were as follows:

Dow Jones – 14.92%

SP 500 – 17.88%

Bloomberg Aggregate Bond Index – 7.08%

Vanguard Balanced Index – 13.61%

Your individual returns are shown in your year-end statement.

Looking ahead to 2026, we are remaining balanced. This coming year will be turbulent so caution both ways is prudent. We cannot afford to be “all in” or “all out.”

We also remain concerned about the sky-high deficit of $38 trillion with substantially higher debt service payments due to higher interest rates.

Stock market valuations are relatively high right now, mostly due to very lofty valuations of the top 20 companies by market weighting. The top 20 companies in the SP 500 index represent approximately 45% of the total value as well as the majority of its performance. There are positive things to consider as well. The other 480 companies in the SP 500 are at a reasonable valuation. Interest rates should migrate lower later this year, which is positive for stocks. Unemployment remains at historically low levels and economic demand continues to be strong.

We expect our balanced approach, tailored individually for each client, will continue to yield goodresults over the long term. We would, however, temper our expectations a bit this year. This past year has been uncharacteristically strong and should not set false expectations for the future. We will be in touch over the next few months to discuss your portfolio and unique situation and concerns. We thank you for your business and especially your trust in us. We wish you nothing but the best for an amazing New Year!

Thankfully and respectfully,

Jerry Schuder

President

P.S. – Happy New Year!

-----------------------------------------------------------------------------------------------------------------------------------------

November 2025

Dear Valued Client ,

November is a great month for thanks and for gratitude. It’s also an excellent time to look toward

our 2026 strategy. As interest rates and inflation fall and with the uncertainties of the tariffs and

global economic environment, we remain cautious but fully invested.

After another successful year, we are considering:

1. Taking some profits and rebalancing our portfolios, especially in the technology sector.

2. Reducing risk a bit as valuations migrate ever higher.

3. Extending bond durations and revisiting our laddered strategy; 1-5 years duration versus

money markets and short-term.

We want to wish you and yours a very Happy Thanksgiving and we are truly thankful for your

trust in us.

Thank you,

Jerry Schuder

President

P.S.- If applicable, your Required Minimum Distributions have been sent and finalized. Please

call with any questions regarding this matter.

-----------------------------------------------------------------------------------------------------------------------------------------

October 2025

Dear Valued Client ,

Do you have any old 401Ks left behind at previous employers? We can help you consolidate those accounts into an IRA. There are definite advantages in the consolidation of these accounts. Some of those advantages may include:

Avoiding unnecessary complexity

Convenience

Simplicity of monitoring the portfolio in one place

Chance of increased performances due to increased scrutiny

Possible lower costs

Fewer statements

Simpler Required Minimum Distribution obligations

Ease of Estate planning

A much broader selection of investments & ETFs

Lessens the risk of “forgotten” accounts

And of course, Sage Investment Advisers handle the rollover, provide ongoing

investment advice, and monitor the account.

Please let us know if we can help!

Thanks,

Jerry Schuder

President

P.S. – Did you know that after 59 ½, you may rollover some or all of your 401K, even if

you are still working for that company? In many cases it’s prudent to build your plan and

investment policy statement well before your retirement date.

-----------------------------------------------------------------------------------------------------------------------------------------

September 2025

Dear Valued Client ,

Social Security is always near the top of the list when discussing retirement with our clients. There is a confusing array of decisions to be made which will affect your retirement plan for decades.

Sage Investment Advisers LLC is a fiduciary and expert at navigating the Social Security Optimization maze. Contact us to schedule a meeting if you are nearing the time for Social Security decisions. Plan in advance so there will not be regret in the future.

Enclosed, please find some very helpful information on Social Security. This can be a great resource for you and your family.

Please feel free to reach out with any questions or for help needed.

Thanks,

Jerry Schuder

President

SOCIAL SECURITY OPTIMIZATION

A Sage Investment Advisers guide to optimizing your social security benefits

Social Security can be a crucial component of your retirement income and strategically

optimizing when and how you claim benefits can significantly impact your financial

security in retirement.

Here is a breakdown of key strategies to maximize your Social Security:

1. Understand your full retirement age (FRA)

Your Full Retirement Age is when you’re eligible for 100% of your Social

Security benefit.

It ranges from 66 to 67 depending on your birth year.

Claiming benefits before FRA results in a permanent reduction, while

delaying benefits beyond your FRA can significantly increase them.

2. Delaying benefits (up to age 70)

For each year you delay claiming Social Security past your FRA, your

benefits increase by approximately 8%, up to age 70.

This increase is known as Delayed Retirement Credits (DRCs).

Delaying allows your benefits to grow, potentially resulting in a higher

monthly payment for the rest of your life.

However, if you have health issues or believe you may have a shorter life

expectancy, claiming earlier might be a better strategy.

3. Spousal benefits

If you’re married, you may be able to claim a benefit based on your

spouse’s work record, up to 50% of their full retirement benefit.

You can claim spousal benefits even if you have your own work record,

you’ll receive the higher of the two amounts, according to AARP.

Generally, you must be at least 62 years old or caring for a child who is

younger than 16 or has a disability and is entitled to benefits on your

spouse’s record.

4. Divorced spousal benefits

Even if you’re divorced, you may be eligible for benefits based on your ex-

spouse’s earnings record.

To qualify, you must have been married at least 10 years, be unmarried

when you apply (unless remarriage occurred after age 60, or age 50 if

disabled), and be at least 62 years old.

Claiming divorced spousal benefits doesn’t affect your ex-spouse’s

benefits or those of their current spouse.

5. Survivors benefits

If your spouse or ex-spouse passes away, you may be eligible for survivor

benefits.

Eligibility criteria and benefit amounts depend on factors like your age,

relationship to the deceased, and whether you are caring for their children.

Claiming survivor benefits can be complex, and it’s essential to

understand how it interacts with your own retirement benefits.

The Social Security Administration recommends contacting them to

discuss your options and determine the best strategy for your situation.

6. Integrating with overall retirement strategy

Social Security should be considered as part of your broader retirement

plan, including other income sources like pensions, 401(k)s, IRAs, and

annuities.

You may consider delaying Social Security benefits and drawing from

other savings or guaranteed income streams.

Understanding the tax implications of different income sources in

retirement is also crucial.

Important considerations

Life Expectancy: If you anticipate a long life, delaying benefits until age 70 may

lead to greater lifetime benefits.

Health: If your health is poor, claiming earlier might be a sensible decision to

access benefits sooner.

Need for Income: If you need the income sooner, claiming at FRA or even

earlier may be necessary, but be aware of the benefit reduction.

Working while receiving benefits: If you claim benefits before FRA and

continue working, your earnings above a certain limit may temporarily reduce

your benefits. This limit no longer applies once you reach FRA.

Taxation: Up to 85% of Social Security benefits may be taxable, depending on

your combined income.

It is highly recommended to consult with Sage Investment Advisers or the

Social Security Administration directly for personalized guidance and to

determine the most optimal strategy for your specific situation. You can also

create a personal “my Social Security” account at www.ssa.gov/myaccount to

access your earnings history and benefit estimates.

-----------------------------------------------------------------------------------------------------------------------------------------

August 2025

Dear Valued Client ,

We wanted to take a minute to make you aware of our client solutions and offerings that go beyond the scope of everyday investment and financial planning.

Our Vice President here at Sage, Mr. Joseph Guarneri, is a long-time expert in the areas of Real Estate Investment as well as business “turn-arounds”

and valuation. Joe has over 30 years of real-world success and experience in these areas and even teaches this knowledge at a collegiate level.

We would be excited and honored to help you with any Real Estate Investment needs such as target acquisitions, valuation, cash flow analysis, and more. We can also help in any business consulting capacity you may need such as acquisitions, succession planning, valuation, turn-around, operations, or

best practices.

Please reach out and let us know how we can help. As always, we are here for you.

With thanks,

Jerry Schuder

President

P.s.- We also provide a Fundamentals of Saving and Investing Class for your children and grandchildren.

Please inquire if you’d like us to email the link!

-----------------------------------------------------------------------------------------------------------------------------------------

July 2025

Our 6-year anniversary for Sage Investment Advisers is right around the corner! We are growing steadily, very stable, and in a very strong position for long-term success for our clients.

We are also proud and grateful to announce some prestigious awards this year.

March 2025 – Daily Voice as Reader’s Choice for Best Financial Advisor

March 2025 – 5 Star Wealth Magazine award, recognized in Hudson Valley Magazine &

Fortune

April 2025 – USA Today for Best Financial Advisory Firms nationwide

July 2025 – Hudson Valley Magazine for Best Financial Planner in the Hudson Valley,

NY

We wanted to take a moment to sincerely express our gratitude. We are excited and thankful for

your business and honored with the trust you have placed in us. None of this would be possible

without you. Thank you so much!

We also want to thank our amazing staff. We are extremely fortunate to have the vast

experience of our six-person team. Their dedication, passion, positive attitude, and work ethic

are deeply appreciated!

Have a wonderful summer!

Truly yours,

Jerry Schuder

President

P.s. – We are often asked if we are accepting new clients by those that want to refer friends and

family to us. The answer is yes, of course! We are always happy to treat your family as ours. We

are grateful for all of your referrals.

(Note: Our $250,000.00 minimum does not apply to a referral of a friend or family member.)

-----------------------------------------------------------------------------------------------------------------------------------------

June 2025

Dear Valued Client ,

Take a look at our website at www.sageinvestmentadvisersllc.com. It offers an easy-to-

use portal to access your accounts held at Charles Schwab. In addition to account

access, there is lots of great information, articles, investment tips, and financial

calculators.

A digital course on the Fundamentals and Basics of Investing and Financial Planning is

available. This course is given by our own Vice President, Joe Guarneri and is terrific for

your kids and grandkids. Please reach out to us if you would like access to the course.

At Sage Investment Advisers there are a range of services beyond the scope of

everyday investing and financial planning. We offer expert level advice in real estate

investments, business consulting/valuations, and business “turnaround”. We can assist

in target acquisitions, cash flow analysis, best practices and whatever else you may

need.

Feel free to let us know if there are any topics or areas of need or interest that we may

have excluded. What would you like to see? We value your input.

Please reach out anytime and let us know how we can help. As always, we are here for

you.

With thanks,

Jerry Schuder

President

-----------------------------------------------------------------------------------------------------------------------------------------

May 2025

Dear Valued Client ,

Federal deficit questions, tariff concerns, political division, and geo-political tension have all been in the news lately. All of this news and rhetoric has caused a significant uptick in market volatility. Equities have felt significant pressure. Currently, there is a lack of visibility regarding the global economy and markets. This makes it rather difficult to make financial and investment decisions in the short term.

These tumultuous times are a reminder of some very sound principles and concepts.

1. We have been preaching caution (thankfully) for some time now. Our concern has not been politics but valuations.

2. Your long-term financial plan and investment policy drive our decisions for you, first and foremost. Your long-term needs and wishes hold far more weight than

short-term reaction. This is your path, stay the course. We will continue to focus on your long-term goals.

3. We will not advise you to “get all out” or “go all in”. Missing the 10 best trading days in the last 20 years would have cut your returns in half. The best days

usually come shortly after the worst days. We cannot predict day to day variation, and it is simply too dangerous to try and time the market.

4. Most importantly, we are watching the markets daily. We do not, and will not, put you in a position to “lose all of your money”. It will go up and it will go down

sometimes.

As long as the world doesn’t end, it will not go away. We are long- term investors, not traders. We watch the markets daily so that you do not have to.

Truly yours,

Jerry Schuder

President

-----------------------------------------------------------------------------------------------------------------------------------------

April 2025

Dear Valued Client ,

We just wanted to remind you that Treasury Bond Yields are still quite high relative to recent history. CD’s and high yield money funds are currently attractive as well.

For months we have been preaching caution due to the uncertainty in the markets. Treasuries are the historic safe harbor during volatile political and market conditions.

In the current market, we feel treasuries are a superior option because:

1. Short-term rates of 3 months to 2 years pay comfortably in excess of 4%.

2. There is no $250,000 limit due to FDIC Insurance.

3. There is no bank penalty for early withdrawal if liquidity is needed, which allows us to take advantage of possible opportunities elsewhere if it makes sense to you.

4. There is no state tax on interest income.

5. There is enough inventory to build a well-constructed bond ladder.

Call us if you currently hold savings, liquid cash, or old CD’s/Bonds. We can do an analysis and comparison to determine the “after all taxes considered” advantages to you.

Many thanks and Happy Spring!

Sincerely,

Jerry Schuder

President

-----------------------------------------------------------------------------------------------------------------------------------------

March 2025

Dear Valued Client ,

Tax season is an ideal time to consider other facets of your family’s financial plan such as estate

planning & life insurance. As part of the Sage family, you are entitled to a full estate planning

analysis, at no cost to you. Please call us at 845-240-1551 to schedule yours at anytime.

Our estate analysis will help address some of the following:

1. Have you discussed the key points and whereabouts of your estate documents with your

beneficiaries and loved ones?

2. Have you updated and verified both the primary and contingent beneficiaries of all “non-

testamentary” assets such as:

IRAs

Roth IRAs

401Ks

All retirement/pension plans

Annuities

Life insurance

3. Do you have a Will? When was it last updated?

4. Do you have a Durable Power of Attorney? Who is it? Are they still the right choice?

5. Who is your Health Care Proxy?

6. Do you have an updated Living Will/ DNR?

7. Are Trusts something to consider for your family?

Estate planning is perhaps the most “put off” planning item there is. It’s not fun and therefore,

many clients tend to procrastinate here. We encourage you to let us help sooner, not later.

Please call us anytime, we’d love to help.

Thanks,

Jerry Schuder

President

P.S. – We would be happy to review any annuities or life insurance policies also, to determine if

they are still a viable part of your plan.

*your assets are always held by our custodian Charles Schwab

----------------------------------------------------------------------------------------------------------------------------------------------------------

February 2025

Dear Valued Client ,

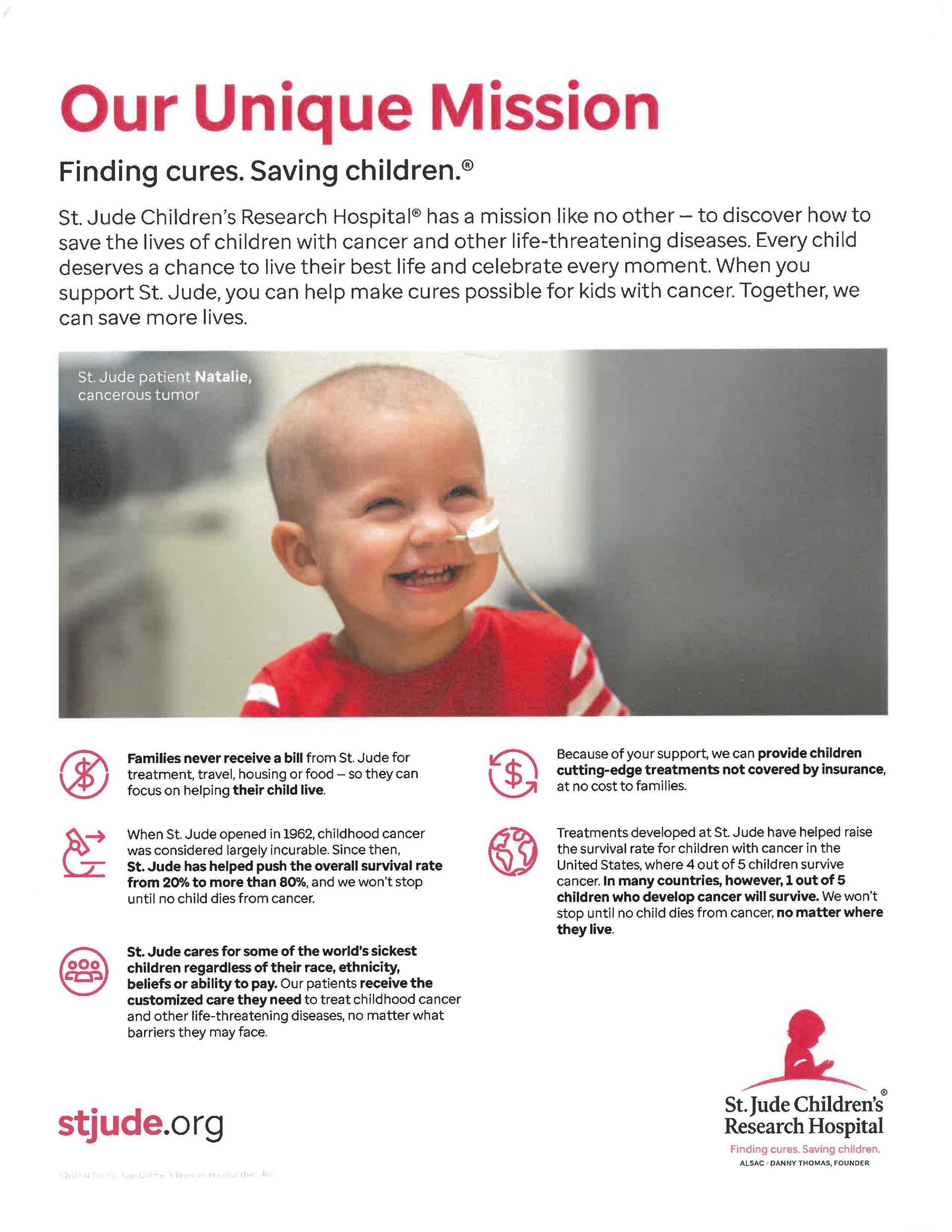

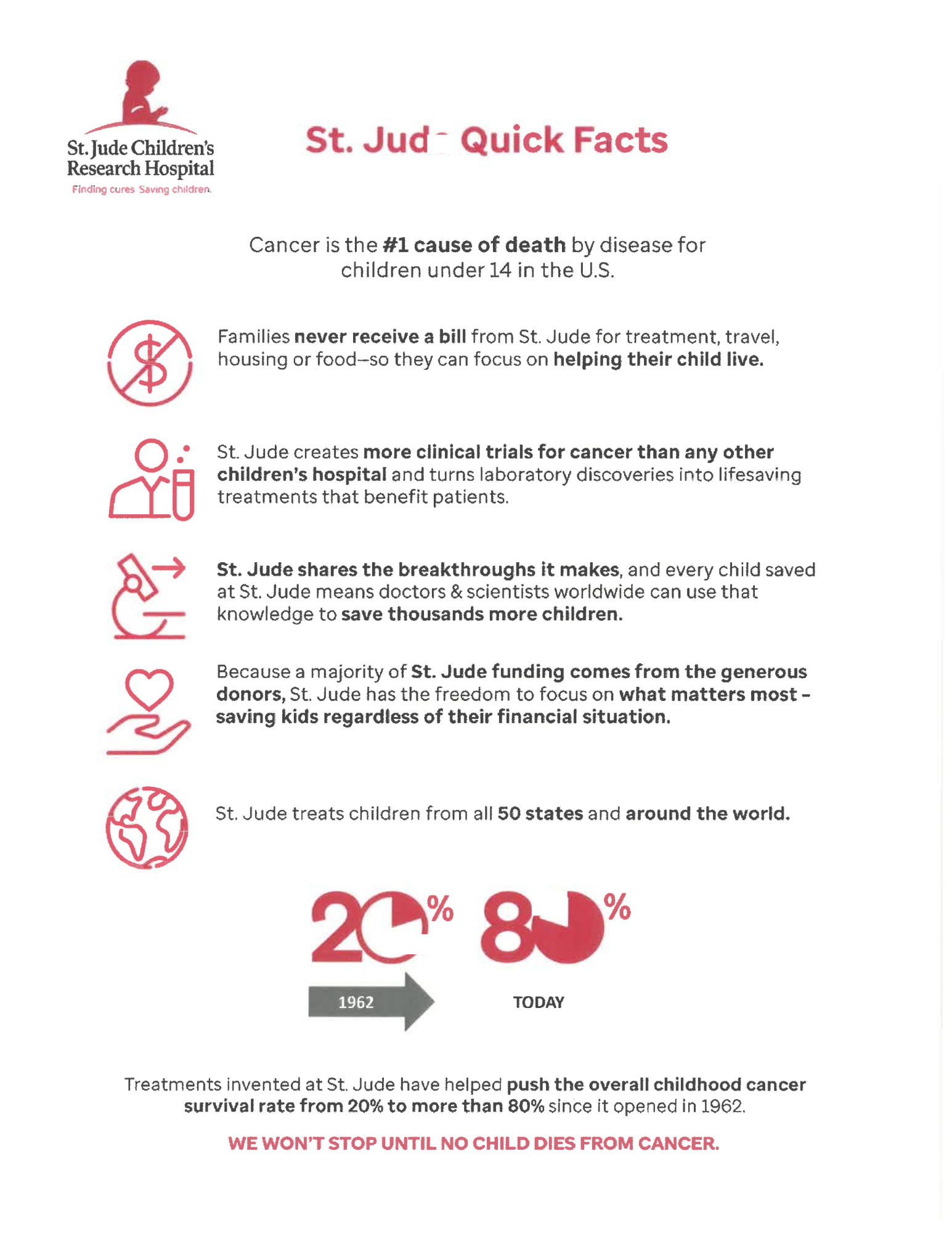

Once again, we are proud to announce our fourth annual St. Jude’s Valentine Fundraiser.

Sage and our clients have raised almost $100,000.00 over the last three years with this campaign.

St. Jude Children’s Research Hospital, founded in 1962, is a pediatric treatment and research facility

focused on children’s catastrophic diseases, especially Leukemia and other cancers. The hospital costs

approximately $2.5-$3.0 million per day to operate, but the children are not charged for their care.

All of us at Sage are grateful for the blessings we have. These kids need our help. We want to give

something back and hope to do so every year.

Our fundraiser will be from 2/14/2025 to 4/1/2025 and our target is to raise $20,000.00. Sage

Investment Advisers will make a gift to St. Jude in honor of each donation made by our friends, our

clients, and our colleagues.

If you wish to join us in our campaign, instructions are given on the next page. All donations are 100%

tax deductible as St. Jude is designated as a 501(c)(3) by the IRS. Thanks so much for helping.

With heartfelt thanks,

Jerry Schuder

President

P.S. – For Valentine’s Day, it’s about them!

----------------------------------------------------------------------------------------------------------------------------------

January 2025

Dear Valued Client ,

The past year has been eventful and quite positive as we had anticipated. The Federal Reserve began its

reduction of key interest rates to their lowest in 2 years. As we write, the Fed has mentioned 2 more

possible rate drops in 2025. The stock market was visibly disappointed as they were expecting 4.

Artificial intelligence has dominated economic headlines and AI-driven companies have dominated with

regards to performance and return. 75% of the broad stock market index returns have been driven by

the Magnificent Seven; mega-cap technology and artificial intelligence-related companies.

We are pleased with the performance of our clients’ accounts. The broad market index returns for 2024,

as of market close 12/31/2024) were as follows:

Dow Jones – 12.88%

SP 500 – 25.02%

Short-term Bond Index – 3.79%

Vanguard Balanced Index – 14.59%

Your individual returns are shown in your year-end statement.

Looking ahead to 2025, we are remaining balanced. This coming year is a tougher read so caution both

ways is prudent. We cannot afford to be “all in” or “all out.”

We also remain concerned about sky-high deficits ($36 trillion & climbing) with substantially higher debt

service payments due to higher interest rates.

Stock market valuations are relatively high right now, mostly due to very lofty valuations of the top 20

companies by market weighting. The top 20 companies in the SP 500 index represent 40% of the total

value as well as the majority of its performance (65%+).

There are positive things to consider as well. The other 480 companies in the SP 500 are at a reasonable

valuation. Interest rates should migrate lower later this year, which is positive for stocks.

Unemployment remains at historically low levels and economic demand continues to be strong.

We expect our balanced approach, tailored individually for each client, will continue to yield good

results over the long term. We would, however, temper our expectations a bit this year. This past year

has been uncharacteristically strong and should not set false expectations for the future.

We will be in touch over the next few months to discuss your portfolio and unique situation and

concerns. We thank you for your business and especially your trust in us. We wish you nothing but the

best for an amazing New Year!

Thankfully and respectfully,

Jerry Schuder

President

P.S. – Happy New Year!

----------------------------------------------------------------------------------------------------------------------------------

November 2024

November is a great month for thanks and for gratitude. It’s also an excellent time to look toward

our 2025 strategy. As interest rates and inflation fall and with the Presidential Election behind

us, we remain cautious but fully invested. After another successful year we are considering:

1. Taking some profits and rebalancing our portfolios, especially in the technology sector.

2. Reducing risk a bit as valuations migrate ever higher.

3. Extending bond durations and revisiting our laddered strategy; 1-5 years duration versus

money markets and short-term.

We want to wish you and yours a very Happy Thanksgiving and we are truly thankful for your

trust in us.

Thanks,

Jerry Schuder

President

----------------------------------------------------------------------------------------------------------------------------------

October 2024

As we enter the 4 th quarter, we will be reaching out to address your Required Minimum

Distributions (if applicable), balancing capital losses against this year’s gains (if applicable), and

to address any needs unique to your portfolio.

We will likely proceed into the new year with caution. The stock market is up considerably and

bonds are still yielding attractive returns. Another great year, however, we see some possible

headwinds. The election is right around the corner, rates are falling as a recession looks

possible. War persists in Israel and Ukraine. Our country continues to add to a $35 trillion debt.

Even with all of these concerns, the markets are still close to all-time highs. Therefore, we are

suggesting staying the course with your investment plan. Every client plan at Sage is custom

tailored to your individual needs. Now is not the time to change what has been working.

In the interim, we hope you have a magnificent fall season and, as always, thank you for your

continued trust in us.

Many thanks,

Jerry Schuder

President

----------------------------------------------------------------------------------------------------------------------------------

September 2024

At Sage Investment Advisers, we have the experience and the expertise to help you with all of

your retirement planning needs. We are your retirement planning gurus.

Do you or does any member of your family have an active 401K? An active workplace

retirement plan? Do you (they) need help with investment selection or management of that

401K?

Do you (or a family member) have an old 401K, 403B, or 457 retirement plan that is still there at

your former workplace? Let us help you consolidate those accounts for easier access and

improved longer-term performance.

You can also transfer your 401K, even if you are still working. However, you must be 59 ½ years

old.

Would you like a no cost consultation on your retirement plan? Please contact us at 845-240-

1551 to schedule one today. You can email an appointment request also to

jnelson@sageinvestmentadvisersllc.com.

Sincerely,

Jerry Schuder

President

P.S.- If any friend or family member needs our help, we will be happy to assist. And, of course,

we will treat them as family!

-------------------------------------------------------------------------------------------------------------------

August 2024

Dear Valued Client,

We wanted to make you aware of our client solutions and offerings that go beyond the

scope of everyday investment and financial planning. Our Vice President here at Sage, Mr. Joseph

Guarneri, is a long-time expert in the areas of Real Estate Investment as well as business “turn-arounds”

and valuation. Joe has over 30 years of real world success and experience in these areas and even

teaches this knowledge at a collegiate level.

We would be excited and honored to help you with any Real Estate Investment needs such as target

acquisitions, valuation, cash flow analysis, and more. We can also help in any business consulting

capacity you may need such as acquisitions, succession planning, valuation, turn-around, operations, or

best practices.

Please reach out and let us know how we can help. As always, we are here for you.

With thanks,

Jerry Schuder

President

--------------------------------------------------------------------------------------------------------------------------------------------------------

July 2024

Dear Valued Client,

Our 5-year anniversary for Sage Investment Advisers is right around the corner! We are growing

steadily, very stable, and in a very strong position for long-term success for our clients.

We are also proud to announce:

In June, we were awarded “2024 5 Star Wealth Manager Award” in the Hudson Valley.

We were recognized in Hudson Valley Magazine & Fortune!

On April 23 rd , USA Today published (2024 edition) “Best Financial Advisory Firms” of

32,600 firms, Sage made the top 500 nationwide!

We wanted to take a moment to sincerely express our gratitude. We are excited and thankful for

your business and honored with the trust you have placed in us. None of this would be possible

without you. Thank you so much!

We also want to thank our amazing staff. We are extremely fortunate to have the vast

experience of our six-person team. Their dedication, passion, positive attitude, and work ethic

are deeply appreciated!

Have a wonderful summer!

Truly yours,

Jerry Schuder

President

P.S. – We are often asked if we are accepting new clients by those that want to refer friends and

family to us. The answer is yes, of course! We are always happy to treat your family as ours. We

are grateful for all of your referrals.

(Note: Our $250,000.00 minimum does not apply to a referral of a friend or family member.)

*your assets are always held by our custodian Charles Schwab

*Sage Investment Advisers LLC is awarded The FIVE STAR Wealth Manager Award in the

Wealth Management Category, based on 10 objective criteria associated with providing

quality services to clients such as credentials, experience, and assets under

management among other factors. Wealth managers do not pay a fee to be considered

or placed on the final list of [Enter Year] Five Star Wealth Managers. The inclusion of a

wealth manager on The FIVE STAR Wealth Manager Award list should not be construed

as an endorsement of the wealth nor should it be inferred that the responses used from

the survey represent the experience of any clients. This award does not evaluate the

quality of service provided and the wealth manager may have had unfavorable ratings.

The rating is not indicative of the wealth manager’s future performance. Five Star

Professional conducts market-specific research to identify service professionals who

provide quality services to their clients. Five Star Professional joins forces with city and

regional magazines to make the research results available to consumers in more than 45

markets across the United States and Canada. Five Star Professional was founded in

2003 and is based in Minneapolis, MN. For more information, go to:

www.FiveStarProfessional.com

----------------------------------------------------------------------------------------------------------------------------------

June 2024

Dear Valued Client,

We are often asked during volatile market trends, “Should we sell everything and get back in later?”.

There are times when we are concerned about downside risk, high valuations, macro-economic factors,

or geo-political concerns. The crowd wants to hurry toward safety. We are aware of these concerns.

Why not sell? Why not “time” the market?

To quote our associate, Mr. Chuck Levinson, (he’s been telling me for many years now!) – “They don’t

ever ring a bell at the top.”

Research by Fidelity Investments demonstrates an important point. The Stock Market often recovers

with sudden big rally days. These days are rare but make up a large share of Market profits. It is quite

expensive to miss the Market’s big rally days.

Given a $10,000 initial investment from January 1, 1980 until March 31, 2021, the invested amount

would grow as follows:

Initial Investment $10,000

Invested all days $1,090,000 balance

Invested missing 5 best days $676,000 balance

Invested missing 10 best days $487,000 balance

Invested missing 30 best days $177,000 balance

Invested missing 50 best days $78,000 balance

To conclude, in volatile times like these, it’s important to adhere to your long-term investment plan. Yes,

we monitor, adjust, and rebalance. But it is simply too dangerous to try to “time” the market.

Thanks, as always, for your business and your trust in us.

Truly yours,

Jerry Schuder

President

P.s. – It’s about you

----------------------------------------------------------------------------------------------------------------------------------

May 2024

We are reaching out to inform you of some terrific resources available to you through Sage Investment

Advisers LLC. Please check out our website @ www.sageinvestmentadvisersllc.com. You can access your

online accounts there and we have many informative articles as well as financial calculators for you to

explore.

We also encourage you to find our “Sage Investment Advisers” page on Facebook and LinkedIn as well. If

you “like” the page and follow us, you’ll receive several good articles every month including our

“Investment Tip Of The Week.”

Feel free to let us know if there are topics you wish to learn more about or features you would like to

see added.

As always, we very much value your input. Thank you.

Respectfully,

Jerry Schuder

President

----------------------------------------------------------------------------------------------------------------------------------

April 2024

Dear Valued Client,

Estate Planning for your loved ones is an essential talk. Too often, clients feel they will get to it

eventually. Simple Estate Planning steps shouldn’t wait.

Here is a brief Estate Planning check-up for everyone:

Do you have a will? If so, when was it last updated?

Do you have a durable Power of Attorney and is the person named still the right choice?

Do you have your Healthcare Proxy and a Living Will?

Should you consider a Trust?

Have you updated and verified your Beneficiary designations on all of your non-

testamentary assets like IRA’s, Roth IRA’s, 401k’s, Annuities, Life Insurance, etc.?

Also a reminder, as part of the Sage family, you are entitled to a full financial planning analysis

and/or Estate Planning review – at any time and at no cost. Just let us know!

Thanks,

Jerry Schuder

President

P.S. – While thinking of estate planning, let Sage review any existing insurance policies or

annuities that you may have to make sure they are still right for you.

----------------------------------------------------------------------------------------------------------------------------------

March 2024

Dear Valued Client,

We just wanted to remind you that Treasury Bond Yields are the highest they have been in many years.

CD’s, high yield money funds, and Agency Bonds are currently attractive.

In the current market, we feel treasuries are a superior option because:

1. Short-term rates of 3 months to 1 year pay comfortably in excess of 5%.

2. There is no $250,000 limit due to FDIC Insurance.

3. There is no bank penalty for early withdrawal if liquidity is needed.

4. There is no state tax on interest income.

5. There is enough inventory to build a well-constructed bond ladder.

Call us if you currently hold savings, liquid cash, or old CD’s/Bonds. We can do an analysis and

comparison to determine the advantages to you.

Many thanks and Happy Spring!

Sincerely,

Jerry Schuder

President

----------------------------------------------------------------------------------------------------------------------------------

February 2024

Dear Valued Client,

Once again, we are proud to announce our third annual St. Jude’s Valentine Fundraiser.

Sage and our clients have raised over $70,000.00 over the last two years with this campaign.

St. Jude Children’s Research Hospital, founded in 1962, is a pediatric treatment and research facility

focused on children’s catastrophic diseases, especially Leukemia and other cancers. The hospital costs

approximately $2.5-$3.0 million per day to operate, but the children are not charged for their care.

All of us at Sage are grateful for the blessings we have. These kids need our help. We want to give

something back and hope to do so every year.

Our fundraiser will be from 2/14/2024 to 4/1/2024 and our target is to raise $20,000.00. Sage

Investment Advisers will make a gift to St. Jude in honor of each donation made by our friends, our

clients, and our colleagues.

If you wish to join us in our campaign, instructions are given on the next page. All donations are 100%

tax deductible as St. Jude is designated as a 501(c)(3) by the IRS. Thanks so much for helping.

With heartfelt thanks,

Jerry Schuder

President

P.S. – For Valentine’s Day, it’s about them!

----------------------------------------------------------------------------------------------------------------------------------

January 2024

Dear Valued Client,

The past year has been as eventful and volatile as we had anticipated. The Federal Reserve continued to

raise key interest rates to their highest levels in a generation. As we write, the Fed has every intention of

keeping these key rates “higher, longer.” “Higher, longer” will absolutely help to shape our investment

strategy as we move forward.

Artificial intelligence has dominated economic headlines and AI-driven companies have dominated with

regards to performance and return. 75% of the broad stock market index returns have been driven by

the Magnificent Seven; mega-cap technology and artificial intelligence-related companies.

You know the names:

Microsoft

Nvidia

Meta (Facebook)

Alphabet (Google)

Apple

Amazon

Tesla

We are pleased with the performance of our clients’ accounts. The broad market index returns for 2024,

as of market close 12/15/2023) were as follows:

Dow Jones – 12.5%

SP 500 – 22.5%

Barclays Aggregate Bond Index – 5.06%

Vanguard Balanced Index – 14.6%

Your individual returns are shown in your year-end statement.

Looking ahead to 2024, we are remaining balanced. This coming year is a tougher read so caution both

ways is prudent. We cannot afford to be “all in” or “all out.”

Our concerns are that “sticky” interest rates, a hard-landing recession, geo-political flare-ups, and a

volatile election year may affect the market. We also remain concerned about sky-high deficits ($34

trillion & climbing) with substantially higher debt service payments due to higher interest rates.

Stock market valuations are relatively high right now, mostly due to very lofty valuations of the top 20

companies by market weighting. The top 20 companies in the SP 500 index represent 40% of the total

federal value as well as the majority of its performance (87%). If it weren’t for the top 7 tech giants, the

index would be flat to single-digit returns.

There are positive things to consider as well. The other 480 companies in the SP 500 should start to

perform again. Interest rates may fall, which is positive for stocks. Unemployment remains at historically

low levels and economic demand continues to be strong.

We expect our balanced approach, tailored individually for each client, will continue to yield good

results.

We will be in touch over the next few months to discuss your portfolio and unique situation and

concerns. We thank you for your business and especially your trust in us. We wish you nothing but the

best for an amazing New Year!

Thankfully and respectfully,

Jerry Schuder

President

P.S. – Happy New Year!

----------------------------------------------------------------------------------------------------------------------------------

December 2023

---------------------------------------------------------------------------------------------------------------------------------

November 2023

Dear Valued Client ,

November is the season for Thanksgiving. At Sage Investment Advisers we have a lot to be thankful for!

We are thankful for our outstanding staff, who made the Charles Schwab/ TD Ameritrade merger and

the move to our new office building smooth and seamless.

Most of all, we are thankful for you, our clients, who have put your trust in us!

Thanksgiving is traditionally a time to think of family. It is a good time to assure your family legacy is

intact by verifying these basic Estate Planning principles:

1. Do you have a will?

2. When was it updated?

3. Who is your Durable Power of Attorney for financial decisions if you ever become incapacitated?

4. Who is your Health Proxy?

5. Do you have a Living Will?

6. Do you have a Trust? If not, should we discuss the concept of establishing a Trust for your

family?

Because you are part of the Sage family, we can provide a full Estate Planning Analysis for your family at

no cost to you. Please contact us if you would benefit from a review. We would love to help!

Sincerely,

Jerry Schuder

President

P.S. – Now there is a rare opportunity in the U.S. Government Treasury Bonds.

5.5% annual return

U.S. Government directly guaranteed

No FDIC limits

No contract/ prepayment penalty

Contact us to see if U.S. Treasuries are right for you!

*your assets are always held by our custodian Charles Schwab

---------------------------------------------------------------------------------------------------------------------------------

October 2023

Dear Valued Client ,

We are comfortably ensconced in our new office. It is fantastic! The central location will allow us to

serve you better and is more convenient for meetings.

Thank you to everyone who came to our Grand Opening to help us celebrate! Your response, over 250

people, was overwhelming and humbling. It is truly an honor to serve you.

We will be contacting you prior to year-end to address the following:

1. Your Required Minimum Distribution (RMD) if any

2. Capital Gains tax harvest (gain or loss)

3. Investment strategy specific to you and your family heading into 2024

4. Any questions or concerns you wish to discuss

If you prefer an in-office meeting, please contact Jennifer or Christina @ (845) 240-1551 for a date and

time that is best for you.

Many thanks as always,

Jerry Schuder

President

*your assets are always held by our custodian Charles Schwab

---------------------------------------------------------------------------------------------------------------------------------

September 2023

FYI: WE HAVE MOVED!

Dear Valued Client ,

We have some exciting news!

As we head toward the 4 th quarter, Sage Investment Advisers has acquired and renovated a building to

call our permanent home!

Here are a few important takeaways:

1. As of 9/11/23, our new address will be 1829 South Road, Rte.9, Wappingers Falls, NY 12590.

The building is the old “Futon Store” across from Kohl’s.

2. All phone numbers, emails, cell phone numbers, etc. will remain the same.

3. We are having a Grand Opening/ Ribbon Cutting Celebration on Thursday, October 12 th from

4pm-8pm.

We will have catering, beer, wine, champagne, live music, & favors. You will be receiving a formal

invitation very soon. We would love to see you there!

Please RSVP with a call to Jen at (845) 240-1551 or a text to Jerry (914) 456-1185.

Thanks,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

August 2023

Dear Valued Client ,

We wanted to take a minute to make you aware of our client solutions and offerings that go beyond the

scope of everyday investment and financial planning. Our Vice President here at Sage, Mr. Joseph

Guarneri, is a long-time expert in the areas of Real Estate Investment as well as business “turn-arounds”

and valuation. Joe has over 30 years of real world success and experience in these areas and even

teaches this knowledge at a collegiate level.

We would be excited and honored to help you with any Real Estate Investment needs such as target

acquisitions, valuation, cash flow analysis, and more. We can also help in any business consulting

capacity you may need such as acquisitions, succession planning, valuation, turn-around, operations, or

best practices.

Please reach out and let us know how we can help. As always, we are here for you.

With thanks,

Jerry Schuder

President

P.s. – It’s about you (and your business!)

---------------------------------------------------------------------------------------------------------------------------------

July 2023

Dear Valued Client ,

As we approach our 4-year anniversary in mid-July we couldn’t be more excited or grateful. We are

growing rapidly, very stable, and in a strong position for long-term success for our clients.

We are also proud to announce:

Early fall season we will be moving to our new building & location. It will be located at 1829

South Rd, Wappingers Falls, NY 12590 (formerly The Futon Store). We are planning an Open

House with food and drinks and will be in touch via invitation. We’d love to see you there!

In July, we were awarded the “2023 5-Star Wealth Manager Award” in the Hudson Valley. We

were recognized in Hudson Valley Magazine and Fortune.

We wanted to take a moment to sincerely express our gratitude. We are excited and thankful for your

business and humbled by the trust you’ve placed in us. None of this would be possible without you.

Thank you so much.

We also want to thank our amazing staff. We are very fortunate to have the vast experience of our six-

person team. Their experience, passion, positive attitude, and work ethic are truly appreciated.

A word about the markets. As we mentioned in our January letter, 2023 is a year for cautious optimism.

As of mid-year (6/22/23), the S&P 500 Index is up 13.70% and the Dow Jones Industrial Average is up

2.68%. Our typical balanced account (50% stocks – 50% bonds) is up 6.09%. Our All-Equity Global

Portfolio is up 8.9%. (Every account is different. Your individual performance is reflected on your

monthly statements.) We are monitoring the markets closely and, counter intuitively, may be looking to

purchase at value prices if a slide occurs. Please remember, every client and every account are different.

Your situation is special, and we are always here to discuss your specific needs. Call us anytime.

Have a safe, magnificent summer!

Truly yours,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

June 2023

Dear Valued Client,

Estate Planning for your loved ones is an essential talk. Too often, clients feel they will get to it eventually. Simple Estate Planning steps shouldn’t wait.

Here is a brief Estate Planning check-up for everyone:

Do you have a will? If so, when was it last updated?

Do you have a durable Power of Attorney and is the person named still the right choice?

Do you have your Healthcare Proxy and a Living Will?

Should you consider a Trust?

Have you updated and verified your Beneficiary designations on all of your non-testamentary assets like IRA’s, Roth IRA’s, 401k’s, Annuities, Life Insurance, etc.?

Also, a reminder, as part of the Sage family, you are entitled to a full financial planning analysis and/or Estate Planning review – at any time and at no cost. Just let us know!

Thanks,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

May 2023

Dear Valued Client,

Estate Planning for your loved ones is an essential talk. Too often, clients feel they will get to it eventually. Simple Estate Planning steps shouldn’t wait.

Here is a brief Estate Planning check-up for everyone:

• Do you have a will? If so, when was it last updated?

• Do you have a durable Power of Attorney and is the person named still the right choice?

• Do you have your Healthcare Proxy and a Living Will?

• Should you consider a Trust?

• Have you updated and verified your Beneficiary designations on all of your non-testamentary assets like IRA’s, Roth IRA’s, 401k’s, Annuities, Life Insurance, etc.?

Also a reminder, as part of the Sage family, you are entitled to a full financial planning analysis and/or Estate Planning review – at any time and at no cost. Just let us know!

Thanks,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

April 2023

Dear Valued Client,

We are reaching out to inform you of some terrific resources available to you through Sage Investment

Advisers LLC. Please check out our website @ www.sageinvestmentadvisersllc.com. We have many

informative articles as well as financial calculators for you to explore.

We also encourage you to find our “Sage Investment Advisers” page on Facebook and newly on LinkedIn

as well. If you “like” the page and follow us, you’ll receive several good articles every month including

our “Investment Tip Of The Week.”

Feel free to let us know if there are topics you wish to learn more about or features you would like to

see added.

As always, we very much value your input. Thank you.

Respectfully,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

March 2023

Dear Valued Client,

We just wanted to remind you that Treasury Bond Yields are the highest they have been in many years.

They are currently far superior to Money Market funds, CD’s, Muni-bonds, Corporate Bonds, and Fixed

Annuities.

In the current market, we feel treasuries are a superior option because:

1. Short-term rates of 3 months to 1 year pay comfortably in excess of 5%.

2. There is no $250,000 limit due to FDIC Insurance.

3. There is no bank penalty for early withdrawal if liquidity is needed.

4. There is no state tax on interest income.

5. There is enough inventory to build a well-constructed bond ladder.

Call us if you currently hold savings, liquid cash, or old CD’s/Bonds. We can do an analysis and

comparison to determine the advantages to you.

Many thanks and Happy Spring!

Sincerely,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

February 2023

Dear Valued Client,

We are humbled, hopeful, and proud to announce our second annual St. Jude’s Valentine Fundraiser.

St. Jude Children’s Research Hospital, founded in 1962, is a pediatric treatment and research facility

focused on children’s catastrophic diseases, especially Leukemia and other cancers. The hospital costs

approximately $2.5-$3.0 million per day to operate, but the children are not charged for their care.

All of us at Sage are grateful for the blessings we have. These kids need our help. We want to give

something back and hope to do so every year.

Our fundraiser will be from 2/14/2023 to 4/1/2023 and our target is to raise $20,000.00. Sage

Investment Advisers will make a gift to St. Jude in honor of each donation made by our friends, our

clients, and our colleagues.

If you wish to join us in our campaign, instructions are given on the next page. All donations are 100%

tax deductible as St. Jude is designated as a 501(c)(3) by the IRS. Thanks so much for helping.

With heartfelt thanks,

Jerry Schuder

President

P.S. – For Valentine’s Day, it’s about them!

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

January 2023

Dear Valued Client,

This past year (2022) has been a difficult one. We have seen the highest inflation in years. The stock and

bond markets were both down double digits. Geopolitical events and rumors, like the Russian-Ukrainian

conflict and the China-Taiwan tensions, elevated economic pain everywhere. Supply chain problems

continue to persist.

In 2022 the SP500 was down 19.44%. The NASDAQ was down 32.54%. The Barclays Aggregate Bond

Index was down nearly 11%, its worst performance since 1977 when the Index began. The Vanguard

Balanced Account was down 17.1%.

Our balanced portfolio was down 12.56% for the year. This best represents our typical client account,

although, at Sage, no client is typical, and all accounts are custom set to your needs. Your individual

performance is represented on the end of the year statement. Although we are never pleased with

negative years, we are pleased with our performance, given the market underperformance. This again

demonstrates that our conservative, asset allocation driven philosophy protects clients’ long-term

wealth, even in down markets.

Looking ahead to 2023, we are remaining cautious. We will look to adjust portfolios when we have some

more visibility on the possible recession as well as the Feds’ interest rate policy. This does not mean that

this will be another negative year. The Stock Market is a leading indicator and we do believe there will

be opportunity.

We, at Sage Investment Advisors, continue to work diligently to guide our clients through the risk and

volatility of these unprecedented times. We will be in touch in January/February to review your portfolio

and your own unique needs and concerns.

We thank you for your business and especially your trust in us. We wish you an amazing and prosperous

2023.

Truly yours,

Jerry Schuder

President

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

December 2022 Letter

Dear Valued Client,

---------------------------------------------------------------------------------------------------------------------------------

November 2022 Letter

Dear Valued Client,

November is the perfect month to give thanks and be grateful. It is also a great time to plan our strategy

for 2023. We will be in touch to discuss your Required Minimum Distribution (RMD), if applicable, and

also any tax selling to harvest gains and losses, if we haven’t reached out already.

We continue to stay balanced and cautious ahead of what is proving to be a very volatile 4 th Quarter.

Our economy continues to struggle with inflation, supply side issues, and a very hawkish Federal

Reserve. Fourth Quarter earnings have been mixed, with visibility being a real issue.

It appears likely we are headed towards a recession. Some economists feel we are already in one. The

Federal Reserve continues to aggressively raise interest rates and the “yield-curve” remains inverted

(the 2-year Treasury Bonds pay more than the 10-year Treasury Bonds). Since the Stock Market is a

leading indicator of the overall economy; the markets being down in 2022 points to a recession in 2023.

However, the Stock Market could very well move higher next year in anticipation of the ending of a

recession.

We are staying cautious with regards to stock market investments unless we see a substantial further

decline. We would raise our equity targets if we see further substantially lower valuations.

We wish you an amazing Thanksgiving and, as always, we are thankful and grateful for your trust in us.

With kind regards,

Jerry Schuder

President

P.s. – It’s about you!

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

October 2022 Letter

Dear Valued Client,

We wanted to take a minute to make you aware of our client solutions and offerings that go beyond the

scope of everyday investment and financial planning. Our Vice President here at Sage, Mr. Joseph

Guarneri, is a long-time expert in the areas of Real Estate Investment as well as business “turn-arounds”

and valuation. Joe has over 30 years of real world success and experience in these areas and even

teaches this knowledge at a collegiate level.

We would be excited and honored to help you with any Real Estate Investment needs such as target

acquisitions, valuation, cash flow analysis, and more. We can also help in any business consulting

capacity you may need such as acquisitions, succession planning, valuation, turn-around, operations, or

best practices.

Please reach out and let us know how we can help. As always, we are here for you.

With thanks,

Jerry Schuder

President

P.s. – It’s about you (and your business!)

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

September 2022 Letter

Dear Valued Client,

As we approach the fourth quarter and move towards year-end, the Federal Reserve and inflation

continue to headline our thoughts.

The next Federal Reserve meeting will be September 20 th -21 st and will provide some more visibility for

the next quarter or so. In the interim, caution is, and has been, the best strategy this year.

We are considering the following items for your account:

1. Your Required Minimum Distribution (RMD) if any

2. Capital Gains tax harvest

3. Market volatility and performance

4. Any tactical investment decisions unique to your situation

5. Any of your concerns and questions

We will have Jennifer or Peg reach out to you to set a meeting time to discuss these topics.

Many thanks, as always,

Jerry Schuder

President

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

August 2022 Letter

Dear Valued Client,

We are often asked during volatile bear market trends, “Should we sell everything and get back in

later?”.

There are times when we are concerned about downside risk, high valuations, macro-economic factors,

or geo-political concerns. The crowd wants us to hurry toward safety. We are aware of these concerns.

Why not sell? Why not “time” the market?

To quote our associate, Mr. Chuck Levinson, (he’s been telling me for many years now!) – “They don’t

ever ring a bell at the bottom.”

Research by Fidelity Investments demonstrates an important point. The Stock Market often recovers

with sudden big rally days. These days are rare but make up a large share of Market profits. It is quite

expensive to miss the Market’s big rally days.

Given a $10,000 initial investment from January 1, 1980 until March 31, 2021, the invested amount

would grow as follows:

Initial Investment

$10,000

Invested all days

$1,090,000 balance

Invested missing 5 best days

$676,000 balance

Invested missing 10 best days

$487,000 balance

Invested missing 30 best days

$177,000 balance

Invested missing 50 best days

$78,000 balance

To conclude, in volatile times like these, it’s important to adhere to your long-term investment plan. Yes,

we monitor, adjust, and rebalance. But it is simply too dangerous to try to “time” the market.

Thanks, as always, for your business and your trust in us.

Truly yours,

Jerry Schuder

President

P.s. – It’s about you

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

July 2022 Letter

Dear Valued Client,

As we approach our 3-year anniversary in mid-July we couldn’t be more excited or grateful. We are

growing rapidly, very stable, and in a strong position for long-term success for our clients.

We are also proud to announce:

In July, we were awarded the “2022 5-Star Wealth Manager Award” in the Hudson Valley. We

were recognized in Hudson Valley Magazine and Fortune.

RIA CHANNEL ranked Sage Investment Advisers, LLC the 24 th fastest growing Registered

Investment Advisor firm in the United States for 2021; and #1 in the Hudson Valley.

We wanted to take a moment to sincerely express our gratitude. We are excited and thankful for your

business and humbled by the trust you’ve placed in us. None of this would be possible without you.

Thank you so much.

We also want to thank our amazing staff. We are very fortunate to have the vast experience of our six-

person team. Their experience, passion, positive attitude, and work ethic are truly appreciated.

A word about the markets. As we mentioned in our January letter, 2022 is a year for caution and

conservativism. As of mid-year, the S&P Index is down 21% and the NASDAQ is down 28%. Our typical

clients are only down 11% due to our conservative approach. (Every account is different. Your individual

performance is reflected on your monthly statements.) We are monitoring the markets closely and,

counter intuitively, may be looking to purchase at value prices if the slide continues. Please remember,

every client and every account is different. Your situation is special, and we are always here to discuss

your specific needs. Call us anytime.

Have a safe, magnificent summer!

Truly yours,

Jerry Schuder

President

*your assets are always held by our custodian Charles Schwab/TDAI

*Sage Investment Advisers LLC is awarded The FIVE STAR Wealth Manager Award in the

Wealth Management Category, based on 10 objective criteria associated with providing

quality services to clients such as credentials, experience, and assets under

management among other factors. Wealth managers do not pay a fee to be considered

or placed on the final list of [Enter Year] Five Star Wealth Managers. The inclusion of a

wealth manager on The FIVE STAR Wealth Manager Award list should not be construed

as an endorsement of the wealth nor should it be inferred that the responses used from

the survey represent the experience of any clients. This award does not evaluate the

quality of service provided and the wealth manager may have had unfavorable ratings.

The rating is not indicative of the wealth manager’s future performance. Five Star

Professional conducts market-specific research to identify service professionals who

provide quality services to their clients. Five Star Professional joins forces with city and

regional magazines to make the research results available to consumers in more than 45

markets across the United States and Canada. Five Star Professional was founded in

2003 and is based in Minneapolis, MN. For more information, go to:

www.FiveStarProfessional.com

*As reported by RIA CHANNEL per annual filings at the Securities Exchange Commission

(SEC) for Registered Firms with $100 million or more Assets Under Management (AUM)

---------------------------------------------------------------------------------------------------------------------------------

June 2022 Letter

Dear Valued Client,

We are asked frequently, “Do you have any bonds in inventory or cash management alternatives?”

For years, the answer has been, “No.”

Finally, we can confidently answer, “Yes.”

5-year treasuries are yielding around 3% and likely to move higher in the coming months. It’s finally a

good idea to buy bonds again. We recommend bonds at short and intermediate durations of 2-7 years

where we can minimize interest rate risk and still achieve a nice safe return.

If you have excess cash or Money Market assets and are tired of no returns, reach out to us. Let’s discuss

what’s best for you.

Thanks,

Jerry Schuder

President

P.s. – It’s about you

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

May 2022 Letter

Dear Valued Client,

Estate Planning for your loved ones is an essential talk. Too often, clients feel they will get to it

eventually. Simple Estate Planning steps shouldn’t wait.

Here is a brief Estate Planning check-up for everyone:

Do you have a will? If so, when was it last updated?

Do you have a durable Power of Attorney and is the person named still the right choice?

Do you have your Healthcare Proxy and a Living Will?

Should you consider a Trust?

Have you updated and verified your Beneficiary designations on all of your non-testamentary

assets like IRA’s, Roth IRA’s, 401k’s, Annuities, Life Insurance, etc.?

Also, a reminder, as part of the Sage family, you are entitled to a full financial planning analysis and/or

Estate Planning review – at any time and at no cost. Just let us know!

Thanks,

Jerry Schuder

President

---------------------------------------------------------------------------------------------------------------------------------

April 2022 Letter

Dear Valued Client,

We are reaching out to inform you of some terrific resources available to you through Sage Investment

Advisers LLC. Please check out our website @ www.sageinvestmentadvisersllc.com. We have many

informative articles as well as financial calculators for you to explore.

We also encourage you to find our “Sage Investment Advisers” page on Facebook. If you “like” the page

and follow us, you’ll receive several good articles every month including our “Investment Tip Of The

Week.”

Feel free to let us know if there are topics you wish to learn more about or features you would like to

see added.

As always, we very much value your input. Thank you.

Respectfully,

Jerry Schuder

President

P.s. – It’s about you

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------

March 2022 Letter

We wanted to take a moment to discuss the importance of planning across generations. Some families

struggle with financial discussions with their aging parents whereas other families struggle to educate

and discuss financial topics with their younger generations. Both of these generational concerns are a

vitally important piece of every families’ financial foundations and legacy.

We would love to offer you the following planning services at no cost to you or your family:

A full estate planning and financial planning review for your parents/grandparents

An in-depth estate planning review for you (and spouse/partner if applicable)

An educational meeting with/for your children/grandchildren to discuss and teach sound

financial principles

Please feel free to reach out to us to schedule any of the above-mentioned services. We would love to

hear from you.

Thanks so much for your continued trust in us and stay safe out there.

Respectfully,

Jerry Schuder

President

P.S. – It’s about you and THEM!

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

February 2022 Letter

We are humbled, hopeful, and proud to announce our first annual St. Jude’s Valentine Fundraiser.

St. Jude Children’s Research Hospital, founded in 1962, is a pediatric treatment and research facility

focused on children’s catastrophic diseases, especially Leukemia and other cancers. The hospital costs

approximately $2.5-$3.0 million per day to operate, but the children are not charged for their care.

All of us at Sage are grateful for the blessings we have. These kids need our help. We want to give

something back and hope to do so every year.

Our fundraiser will be from 2/14/2022 to 4/1/2022 and our target is to raise $20,000.00. Sage

Investment Advisers will make a gift to St. Jude in honor of each donation made by our friends, our

clients, and our colleagues.

If you wish to join us in our campaign, instructions are given on the next page. All donations are 100%

tax deductible as St. Jude is designated as a 501(c)(3) by the IRS. Thanks so much for helping.

With heartfelt thanks,

Jerry Schuder

President

P.S. – For Valentine’s Day, it’s about them!

*your assets are always held by our custodian Charles Schwab/TDAI

---------------------------------------------------------------------------------------------------------------------------------

January 2022 Letter

This past year (2021) has certainly been eventful. Through political change, an ongoing

pandemic, geo-political concerns, supply chain disruption, and meaningful inflation, the Capital Markets

still produced very strong returns. As of business opening on 12/22/2021, the Dow Jones Industrial Average

was up 17.03% for the year. Our Global-All Equity portfolio (as of 12/22/2021) was up 17.85%.

Aggressive portfolios, in many cases, fared even better. We, at Sage Investment Advisers, continue to

work diligently to guide our clients through the volatility while capturing returns of a great year.

As for 2022, we are ringing the “caution” bell. We are actively reducing client risk by paring

Stock Market exposure by 5-10%. Why? Inflation is here. The Federal Reserve has stated its intent to

raise rates and pare Bond purchases. Inflation is no longer perceived as transitory. Simply put, higher-than-expected

than expected inflation coupled with Market Valuations that are quite rich is a recipe for muted returns

after a banner year. As we approach 2022, new Covid-19 variants, supply chain issues, and strained

healthcare systems continue to add to economic worry as well. Given these conditions and the Fed’s

recent statements, we do not see returns in 2022 being as high as they have been. Our strategy?

Caution and concern, not an overreaction.

We will be in touch in January to discuss your portfolio and your own unique situation and concerns. We

thank you, as always, for your business and especially your trust in us. We wish you nothing but the best

for an amazing New Year!

Thankfully and respectfully,

Jerry Schuder

President

P.S. – Happy New Year!